What can the app FAIA do?

FAIA (Fichier Audit Informatisé AED) is an electronic audit file format required by the Luxembourg tax authorities. It’s used to provide detailed accounting data in a standardized XML format during tax audits. The FAIA file contains all relevant financial transactions, chart of accounts, and VAT data, allowing authorities to efficiently verify the accuracy of a company’s bookkeeping.

Our app enables you to easily export your financial data in the FAIA Full-Scheme format, ensuring compliance with Luxembourg’s legal requirements and simplifying the audit process.

Overview of functions

- Generation of the file for the required calendar year even if the fiscal year is not a calendar year

- Assisted Setup for easy onboarding and mapping of all the needed data

- Mapping your individual chartofaccounts (CoA) tothelocalstandardchartofaccounts (GAAP)

Benefits for you

- Ensures your accounting data meets the specific format required by Luxembourg’s taxauthority (AED) during tax audits

- Automates the FAIA file creation, eliminating the need for manual formatting or data extraction

- Fully integrated in your Microsoft Dynamics 365 Business Central

Technical requirements and use

- Supported editionsThis extension supports both the Essential and Premium of Microsoft Dynamics 365 Business Central.

- Supported countriesLuxembourg and Germany, other countries upon request.

- Supported LanguagesThis app is available in English (United States) and German (Germany).

FAIA is a standardized and structuredfilethatfacilitatesdataexchangebetweentaxpayers and the Luxembourg government. Itisbased on the OECD SAF-T standard (version 2.0) and is an XML auditformatdevelopedspecificallyfor Luxembourg.

The lawofDecember 19, 2008 (“loi du 19 décembre 2008 concernant la coopération interadministrative…”) introducedtheobligationfortaxpayerstoprovidetheir electronic data in a suitable and readable form at therequestofthetaxauthorities.

- Full Schema: For companies with integrated accounting software that combines accounting, billing, and other modules in a single system.

- Reduced schema (version A): For companies with separate but integrated accounting and invoicing software.

- Reduced schema (version B): For companies that only use accounting software; other data must be linked to the accounting system in a structured, exportable format.

Companies subject to the Luxembourg standard chart of accounts (PCN):

- Corporations (S.A., S.à r.l., S.C.A., S.Coop, S.E.)

- Sole proprietorships and partnerships (S.N.C., S.C.S.) with annual turnover exceeding €100,000 (excluding VAT)

- Branches and subsidiaries of foreign companies in Luxembourg

Exceptions:

- Companies supervised by the CSSF or C.A.A. (e.g., banks, credit institutions, and insurance companies)

- Companies that prepare their financial statements in accordance with IFRS or are subject to an exemption under Art. 27 of the Accounting Act of December 19, 2002

Penalties may be imposed as a lump sum of up to €5,000 per violation or as daily penalties ranging from €50 to €1,000. Measures to circumvent or unlawfully refund VAT may also be subject to an additional penalty of 10%.

Audit File FAIA Localization for Luxembourg

Quick Links

- Definitions

- Prerequisites

- Countries/Regions

- Currencies

- Dimensions/VAT Posting Setup

- Assigning Permissions

- Setup

- Assisted Setup

- Manual Setup

- VAT Representative

- Analysis Types

- Tax Codes/Tax Code Countries

- Mapping to the standard Chart of Accounts

- Exporting FAIA

Setup and Usage

Analysis Type

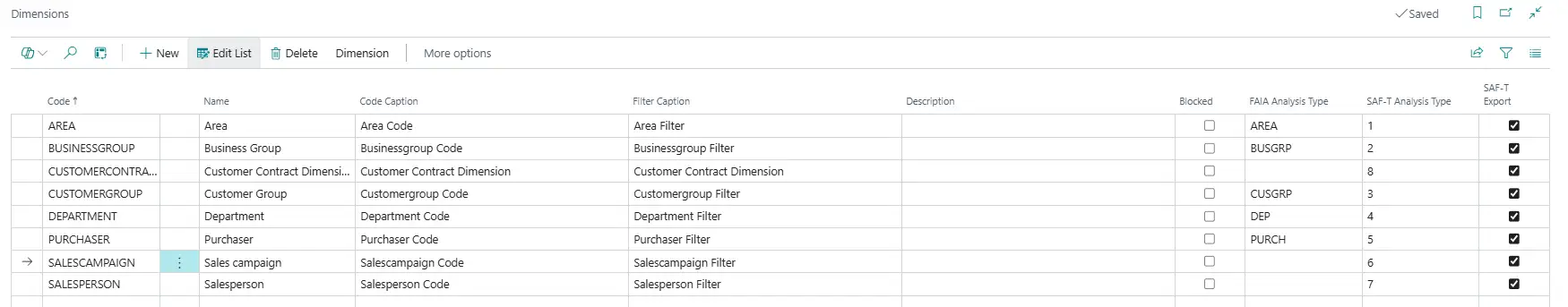

Analysis types act as unique identifiers for your dimensions. As defined by the FAIA scheme, such an identifier must not be any longer than 9 characters, which is why they are defined separately to the actual dimension code. A dimension’s analysis type must not be empty.

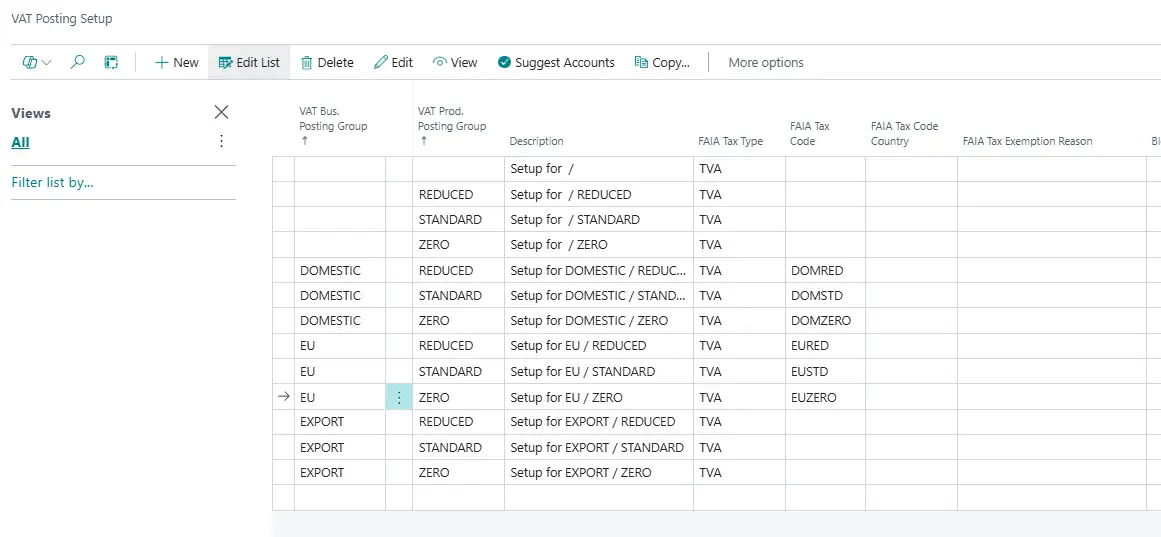

Tax Type

Tax Types are exported along with other information of your VAT posting setup. Currently, there is only one supported tax type: “TVA”. It is automatically created and assigned to every existing line of your VAT posting setup. If a new line is created at a later point in time, you will have to manually assign it the tax type “TVA”.

Tax Code

Tax codes are for the VAT posting setup what analysis types are for dimensions: unique identifiers which are limited to 9 characters.

Tax Code Country

The country, which the respective VAT posting setup line applies to. You should specify this where possible.

Tax Exemption Reason

In case you use reduced VAT rates when buying or selling or if you are exempted from VAT in specific cases, you have to specify a tax exemption reason for the respective lines of your VAT posting setup.

1. COUNTRIES/REGIONS

Country/Region Codes must be set up according to the ISO 3166-1 alpha 2 standard to export a valid file (e.g. LU for Luxembourg).

2. CURRENCIES

Currency Codes must be set up according to the ISO 4217 standard (e.g. EUR for Euro) to export a valid file.

3. DIMENSIONS/VAT POSTING SETUP

If you want to use the assisted setup to get up and running for exporting FAIA, you must first setup dimensions and VAT posting.

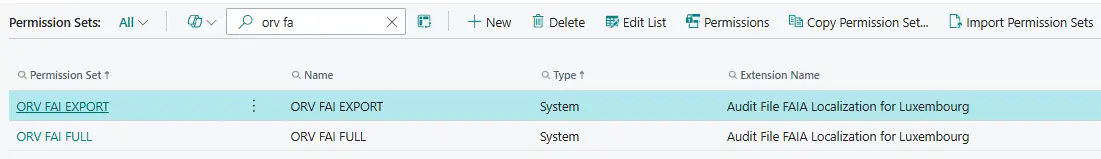

To enable non-super users to setup FAIA or export FAIA files, you are required to assign them a permission set.

- Open the users page by searching for it on the light bulb menu

- Open the card page of the user that you want to grant permissions to FAIA functionality

- Assign one of the following permission sets

- ORV FAI FULL, if you want the user to have full access to FAIA, i.e. to enable him to do the setup and to export FAIA files

- ORV FAI EXPORT, if you only want to enable the user to run the export

A. ASSISTED SETUP

The assisted setup will guide you through all the steps which are necessary to be able to export FAIA files.

When FAIA is installed but not yet ready to use, a notification will show up (to users with setup permissions) on the following role centers:

- Accountant

- Accounting Manager

- Accounting Services

- Bookkeeper

- Business Manager

You can start the setup wizard right from this notification by clicking “Run Setup Wizard”.

Alternatively, the wizard can be started by heading to the assisted setup overview (Light Bulb Menu ➔“Assisted Setup”) and clicking on the entry “Setup Audit File FAIA Localization for Luxembourg”.

The wizard itself is self-explanatory and hence not covered in detail in this document. Refer to I. Definitions if you have problems understanding a term used in the wizard.

B. MANUAL SETUP

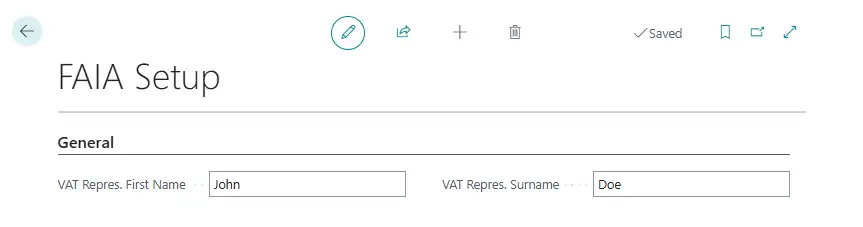

1. VAT REPRESENTATIVE

You have to specify a VAT representative in order to export a FAIA file. The person specified will be exported as your company’s contact person towards the tax authorities. Open the page “FAIA Setup” by searching for it on the light bulb menu and fill in both fields.

2. ANALYSIS TYPES

Refer to I. Definitions for an explanation of analysis types.

- Open the dimensions page by searching for it on the light bulb menu.

- Specify an analysis type code for every dimension.

3. TAX CODES/TAX CODE COUNTRIES/TAX EXEMPTION REASONS

Refer to I. Definitions for an explanation of tax types, tax codes, tax code countries and tax exemption reasons.

- Open the VAT posting setup page by searching for it on the light bulb menu.

- Assign the tax type “TVA” to every line, if it is not already assigned.

- Specify a tax code for each line.

- Specify tax code countries where possible.

- Specify a tax exemption reason for every line which is used for business cases where

- you buy/sell with reduced VAT rates

- you are exempted from VAT (e.g. Reverse Charge)

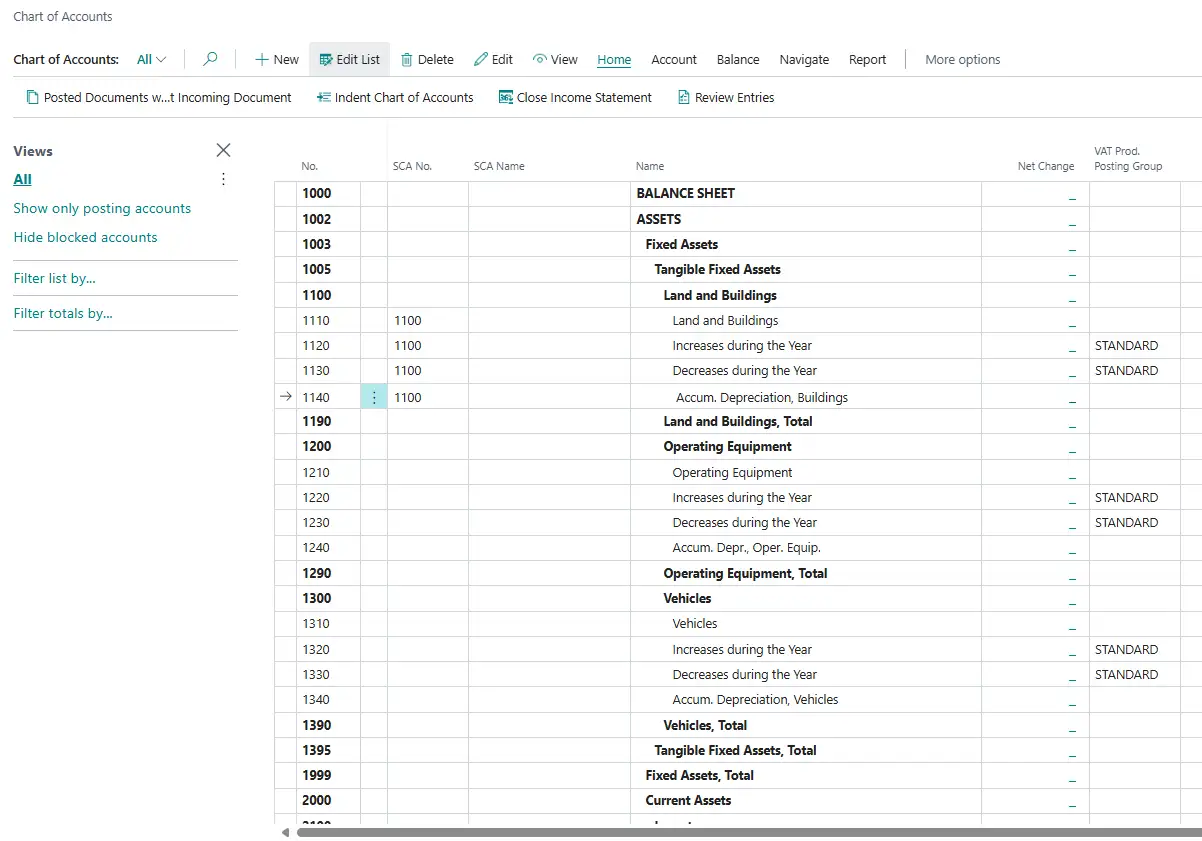

4. MAPPING TO THE STANDARD CHART OF ACCOUNTS

In case you do not use the Luxembourgish standard chart of accounts, you must map your accounts to the standard ones, so that the standard account’s number and name can be used during the export.

- Open the chart of accounts by searching for it on the light bulb menu

- Fill the columns SCA No. and SCA Name with the number and name of the standard account which your account maps to.

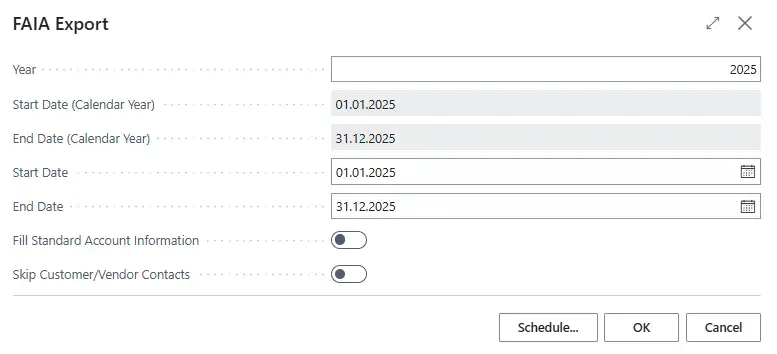

- Open the FAIA Export page by searching for it on the light bulb menu.

- Specify a year. This causes all the date fields to be filled in automatically.

- To avoid exceeding the maximum file size, you can split the export of one calendar year into multiple files:

- Define alternate document export periods within the given calendar year by specifying dates for “Start Date” and “End Date”.

- Repeat the export until you covered the whole calendar year.

By doing this you would, for example, end up having 2 FAIA files for calendar year 2019: one containing the documents from 01.01.2019 – 30.06.2019 and the other one containing the documents from 01.07.2019 – 31.12.2019.

- In case you do not use the Luxembourgish standard chart of accounts, you have to go through IV.B.4. Mapping to the Standard Chart of Accounts. Enable the option “Fill Standard Account Information” to use the configured mapping information during the export.

- Click “OK”. When the export is finished, the browser will

- download the FAIA file to your configured folder or

- ask you where to save the file

- depending on your browser settings

For more information, please contact:

Orgavision S.à r.l.

35, route de l’Europe

L-5531 Remich

Telephone +352 26660091

help.orvapp@orgavision.lu

https://www.orgavision-nav.com